GAUGEMARKETS

FORECASTING PROCESS

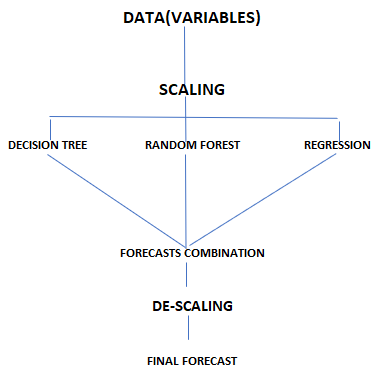

GaugeMarkets generates stock and currency return forecasts by using different machine learning algorithms such as desicion trees, random forest, and neural networks. Thereafter, the forecasts are blended to offer unbiased and good fitting models. The models use data available for the specific moment in time to avoid the look-ahead bias.

The set of variables are made of technical indicators, macroeconomic indicators, and individual stock features(volatility and correlations).

EXPECTED RETURN DISTRIBUTIONS

GaugeMarkets employs Monte Carlo simulations to create a different set of explicatory variables, used to forecast returns, and create distributions.

For volatility, it is used the widely known GARCH model.